Stock Market Volatility Amid President Trump's Escalating Tariffs

By: Ark-La-Tex Staff Writer

Published July 13, 2025

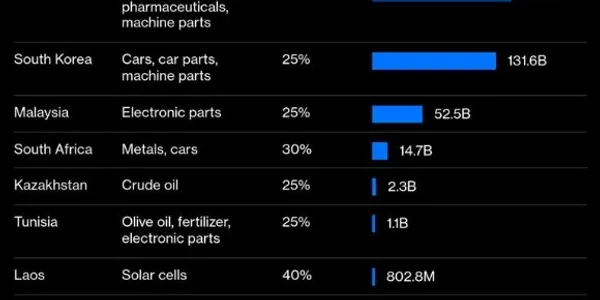

The U.S. stock market experienced renewed volatility this week following President Donald Trump's announcement of significant tariff increases on imports, including a 35% levy on Canadian goods set to take effect on August 1. This move has reignited investor concerns about escalating trade tensions and their potential impact on global economic stability.

On Friday, the S&P 500 closed down 0.33%, the Nasdaq Composite fell 0.22%, and the Dow Jones Industrial Average dropped 0.63%. The declines were attributed to Trump's intensified tariff threats, which included a 50% tariff on Brazilian imports and up to 49% on goods from countries without trade deals, such as Japan and Cambodia.

Despite these developments, the broader market has shown resilience. The S&P 500 remains up approximately 6% for the year, and major indices have reached record highs. Analysts suggest that investors may be viewing the tariff announcements as part of a broader economic strategy, with expectations that the administration will provide clarity and potential relief measures in the near future.

In the pharmaceutical sector, Trump's proposal to impose a 200% tariff on imported drugs has not significantly affected stock prices. Companies like Eli Lilly and Merck have announced plans to increase domestic production, and the administration's "Big Beautiful Bill" offers tax incentives for research and development, which may mitigate potential negative impacts.

However, concerns persist regarding the broader economic implications. The Consumer Price Index (CPI) is expected to show a 0.3% increase for June, potentially raising the annual rate to 2.7%. Analysts are closely monitoring whether rising inflation will lead to delayed interest rate cuts by the Federal Reserve, which could affect investor sentiment.

As the August 1 tariff deadline approaches, market participants are advised to stay informed about policy developments and consider the potential impacts on various sectors. Diversification and a focus on long-term investment strategies may help mitigate risks associated with short-term market fluctuations